Step-by-Step Guide: How to Buy Your First Home in the U.S.?

Buying your first home in the U.S. is a huge, exciting step. I remember feeling a mix of excitement and nerves, wondering if I was missing something important. It’s a process with many steps, from checking your finances to finally getting the keys.

That’s why I’ve put together this simple, complete guide. I’ve broken everything down into three clear phases to walk you through the entire journey. Whether you’re just starting to think about buying or are ready to look at houses, this guide will help you feel confident and in control. Let’s see how to buy a house for the first time in the U.S..

Part 1: Get Your Money and Mortgage Ready

Before you fall in love with a house online, you need to get your finances in order. This first phase is all about understanding what you can afford and getting approved for a loan. Doing this homework upfront will save you time and stress later. Let’s look at the five key steps to prepare your wallet.

1. Figure Out Your True Home-Buying Budget

The first question to ask is: “How much house can I really afford?” It’s not just about the sale price. You need to look at your monthly income, your existing debts (like car payments or student loans), and your living expenses. Lenders will do this by calculating your Debt-to-Income ratio (DTI). This is your total monthly debt payments divided by your gross monthly income. Many lenders prefer a DTI under 43%.

A good rule of thumb I used was the 28/36 rule: don’t spend more than 28% of your gross monthly income on housing costs (mortgage, taxes, insurance), and no more than 36% on total debt. Don’t forget to budget for future home maintenance and repairs—a good rule is to save 1% of your home’s value each year.

2. Save for Your Down Payment and Closing Costs

One of the biggest challenges for first-timers is saving for the upfront cash you’ll need. The down payment can be as low as 3% for some loans or 20% to avoid extra monthly insurance (called PMI). On top of that, you have closing costs, which are typically 3% to 6% of the loan amount for fees like the appraisal, title insurance, and more.

When I was saving, I set up a separate savings account and automatically transferred money from each paycheck. It helped me watch the fund grow without being tempted to spend it. Remember, there are many loan programs and grants for first-time buyers that can help with these costs, which we’ll talk about next.

3. Check and Improve Your Credit Score

Your credit score is a key factor in getting a good mortgage rate. A higher score can save you tens of thousands of dollars over the life of your loan. Start by getting your free credit reports from AnnualCreditReport.com. Check them carefully for any mistakes and dispute errors right away.

To boost your score, focus on paying all your bills on time and try to keep your credit card balances below 30% of your credit limit. Avoid applying for new credit (like a new credit card or car loan) in the months before you apply for a mortgage. If your score needs work, give yourself at least six months to improve it.

4. Explore Your Loan Options and Find the Right Help

There are many types of mortgages. Conventional loans often need higher credit scores (around 620+) and larger down payments. FHA loans are popular with first-time buyers because they allow lower scores (as low as 580) and down payments as low as 3.5%. VA loans offer amazing benefits for veterans and service members, including $0 down. There are also state and local first-time buyer programs that offer grants and assistance.

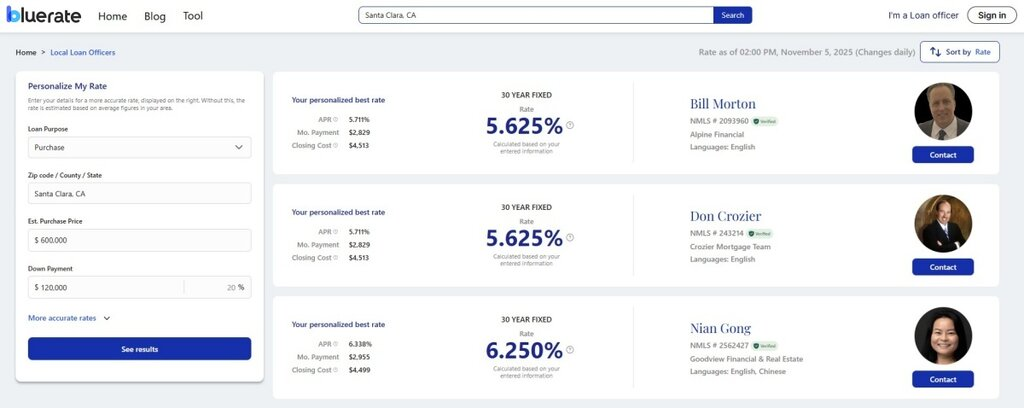

This is where finding the right professional is crucial. In my search, I used Bluerate, a mortgage marketplace that changed the game for me. Instead of a lender assigning you a random loan officer, Bluerate lets you choose your own. You can search for licensed, NMLS-verified loan officers in your area, see their experience, and read about their specialties. It’s easy for you to get non-qm mortgage in CA or any state. Bluerate screens all loan officers to ensure they are qualified and have a clean record.

Here’s what makes Bluerate so helpful for a first-time buyer:

- Real, Upfront Rates: You see actual mortgage rates, not low “teaser” rates that change later.

- Wide Market View: It shows real-time rates from nearly 30 major lenders, all in one place.

- Personalized Rate Calculator: Just enter your credit score, target home price, and income to see rates tailored to you.

- Easy Online Pre-Qualification: You can fill out the main loan application (the 1003 form) online easily and even export your data.

- Fewer Errors: The system helps auto-fill forms to minimize mistakes.

- Fast Credit Checks: Loan officers can check your credit instantly for a quick pre-approval.

- Track Your Loan: You can see your application’s status every step of the way.

- Top-Tier Security: Bluerate is SOC 2 Type II certified, so your personal data is safe.

- Your Privacy is Protected: They never sell your information to other lenders, so no more spam calls.

The best part? Contacting and talking to loan officers on Bluerate is completely free for you. It puts you in control to find the right expert for your needs.

5. Get a Solid Mortgage Pre-Approval

Once you pick a loan officer, the next step is getting a formal pre-approval. You’ll provide documents like pay stubs, bank statements, and tax returns. The lender will check everything and tell you exactly how much they are willing to lend you. This pre-approval letter is powerful—it shows real estate agents and sellers that you are a serious, qualified buyer. In competitive markets, many sellers won’t even look at an offer without a pre-approval letter. Get this done before you start seriously house hunting.

Part 2: Find Your Dream Home and Make an Offer

Now for the fun part! With your pre-approval in hand, you can confidently search for your new home. This phase involves four main steps, from finding an agent to making your offer stand out.

1. Find a Great Real Estate Agent

A good buyer’s agent is your guide and advocate. They know the local market, can find homes that fit your needs, and are skilled negotiators. Ask friends and family for referrals, and then interview a few agents. Find someone who listens to you, communicates well, and has experience in the neighborhoods you like. Remember, in most cases, the seller pays the agent’s commission, so their expertise costs you nothing.

2. Make a “Must-Have” vs. “Nice-to-Have” List

When I first started looking, I wasted time on houses that weren’t right for me. I learned to make two lists. The “Must-Have” list is for things you can’t live without, like the number of bedrooms, location, or a yard. The “Nice-to-Have” list is for dream features, like a renovated kitchen or a swimming pool. This list will help your agent find the perfect homes for you to see and keep you from getting distracted.

3. Tour Homes Like a Pro

Go to open houses and schedule tours with your agent. After seeing a few places, they can all start to blend together. I took photos and notes on my phone for each home. Look past the fresh paint and focus on the important stuff: the age of the roof and HVAC system, the condition of the floors, and any signs of water damage. Visit the neighborhood at different times of day to check for noise and traffic. Don’t be shy—ask lots of questions!

4. Make a Smart and Competitive Offer

When you find “the one,” your agent will help you write an offer. The price should be based on what similar homes in the area have recently sold for. Your offer will also include:

- Earnest Money: A deposit (1-3% of the price) that shows you’re serious.

- Contingencies: These are your “outs” if something goes wrong. The most important are the inspection contingency (you can back out if the inspection finds major problems) and the appraisal contingency (you’re protected if the house is valued for less than your offer).

In a hot market, your agent might suggest strategies to make your offer stronger, like being flexible on the closing date.

Part 3: The Final Steps Before You Get the Keys

Your offer was accepted! Now, it’s all about final checks and paperwork. This last phase has five important steps to make sure the house is a sound investment and to officially make it yours.

1. Schedule the Home Inspection and Appraisal

Hire a professional home inspector to give the house a thorough check-up. It costs a few hundred dollars but is worth it for the peace of mind. I went to my inspection and learned so much about the house. At the same time, your lender will order an appraisal to make sure the home’s value matches the loan amount.

2. Negotiate Repairs or Credits After Inspection

The inspection report might find issues. You can then ask the seller to fix problems, give you a credit at closing to cover repair costs, or lower the sale price. Your agent will guide you on what’s reasonable to ask for based on the market.

3. Shop for Homeowners Insurance

Your lender will require you to have a homeowners’ insurance policy in place before closing. Shop around for quotes to find the best coverage and price. You’ll need to provide your lender with the proof of insurance before you can close.

4. Do a Final Review with Your Lender

Your lender’s underwriter will be finalizing your loan. Be ready to provide any last-minute documents. Three days before closing, you’ll get a “Closing Disclosure” form. Compare it carefully to the initial “Loan Estimate” you received to make sure the numbers are what you expected.

5. Close on Your Home and Move In!

This is it—closing day! You’ll sign a lot of paperwork, including the final loan documents. Bring a government-issued ID and a cashier’s check or wire transfer for your down payment and closing costs. Once everything is signed and the money is transferred, the deed is recorded in your name, and you get the keys. Congratulations, you’re a homeowner!

You’re Ready to Start Your Home-Buying Journey!

Buying your first home is a journey of preparation, patience, and partnership. We’ve walked through the three key phases: getting your finances ready, finding the right home, and closing the deal. Remember, the goal is to make informed decisions without feeling rushed.

Using modern tools can make all the difference. Platforms like Bluerate by Zeitro are designed to empower you, giving you control, transparency, and direct access to vetted loan officers. With real rates, powerful tools, and a firm commitment to your privacy and success, it helps simplify the most complex part of the process.

Your new home is waiting. Take that first step today, and soon you’ll be unlocking the door to your own future.

Finding the Right Luxury Apartment in Philadelphia

March 4, 2025Properties in Malta

February 10, 2025

Comments are closed.

Latest Post

INDEX POST

-

How Epoxy Stain Flooring Performs in Humid South Carolina Weather

November 28, 2025 -

How to Choose a Reliable Plumber in Singapore: A Homeowner’s Guide

November 14, 2025 -

What Are HVAC Dampers And How Do They Direct Airflow?

November 8, 2025 -

Where to Find a Deck Builder in Toronto

November 8, 2025